This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

O-Bank (24 Aug 2021 – 31 Dec 2022)

| Signing Date | 24 Aug 2021 |

| Region of Headquarters: | Asia-Oceania |

| Current EPFI Reporting Year/Period: | 24 Aug 2021 - 31 Dec 2022 |

| Institutional Reporting: | Link to Report |

Please read the important notes and disclaimer for further information on ‘EPFI Reporting’, compliance and publication on the EP website.

Further information on this EPFI may be obtained through the Institutional Reporting hyperlink.

Project Finance Advisory Services

Total number mandated in the reporting period: 0

Project Finance Transactions

Total number that reached Financial Close in the reporting period: 5

| Equator Principles Category | A1 | B2 | C3 |

|---|---|---|---|

| Sector | |||

| Mining | |||

| Infrastructure | |||

| Oil & Gas | |||

| Power | 4 | 1 | |

| Others | |||

| Region | |||

| Americas | |||

| Europe, Middle East & Africa | |||

| Asia Pacific | 4 | 1 | |

| Country Designation | |||

| Designated Country 4 | |||

| Non Designated Country | 4 | 1 | |

| Both | |||

| Independent Review | |||

| Yes | 4 | ||

| No | 1 | ||

| Totals | 4 | 1 | |

Category A – Projects with potential significant adverse environmental and social risks and/or impacts that are diverse, irreversible or unprecedented.

Category B – Projects with potential limited adverse environmental and social risks and/or impacts that are few in number, generally site-specific, largely reversible and readily addressed through mitigation measures.

Category C – Projects with minimal or no adverse environmental and social risks and/or impacts.

Designated Countries are those countries deemed to have robust environmental and social governance, legislation systems and institutional capacity designed to protect their people and the natural environment.

Project-related Refinance & Project-related Acquisition For Project Finance

This information is required under EP4. EP4 applies for those transactions mandated after 1 October 2020 and that have reached Financial Close by the end of the period being reported.

Project Name Reporting For Project Finance (And Project-related Refinance & Project-related Acquisition Finance For Project Finance)

| No. | Project Name | Sector | Project Location(s) | Year of Financial Close |

|---|---|---|---|---|

| 1 | Project T- Tainan, Taiwan | Power | Taiwan, China | 2022 |

| 2 | Project F - Yilan, Taiwan | Power | Taiwan, China | 2022 |

| 3 | Project J – Tainan, Taiwan | Power | Taiwan, China | 2022 |

Number of projects that were not disclosed as per the disclosure conditions specified in Annex B of the Principles: 2

Under EP4, project name reporting is required for Project Finance transactions that have reached Financial Close and encouraged for Project-Related Corporate Loans that have reached Financial Close.

Project-Related Corporate Loans

Total number that reached Financial Close in the reporting period: 0

Project-related Refinance & Project-related Acquisition For Project-related Corporate Loans

This information is required under EP4. EP4 applies for those transactions mandated after 1 October 2020 and that have reached Financial Close by the end of the period being reported.

Implementation of the Equator Principles

The Equator Principles (EPs) is a risk management framework, adopted by financial institutions, for determining, assessing and managing environmental and social risk in projects and is primarily intended to provide a minimum standard for due diligence and monitoring to support responsible risk decision-making.

Since 2015, O-Bank has integrated the Equator Principles into its project finance and corporate loans,

setting corporate customers’ environmental protection, management integrity, risk management and other sustainability-related issues as items for credit risk evaluation.

In addition to signing the Equator Principles, O-Bank has always actively integrated its core business of finance with practicing corporate social responsibility and has become Taiwan’s first financial institution to receive B Corporation certification.

O-Bank has steadily pushed forward with responsible lending and investment measures, aiming to make an impact on sustainability as a financial institution and collaborate with O-Bank’s clients to stride towards sustainability in response to the United Nations Sustainable Development Goals and the international trend of green finance.

Comprehensive Policies and Structure for Implementation

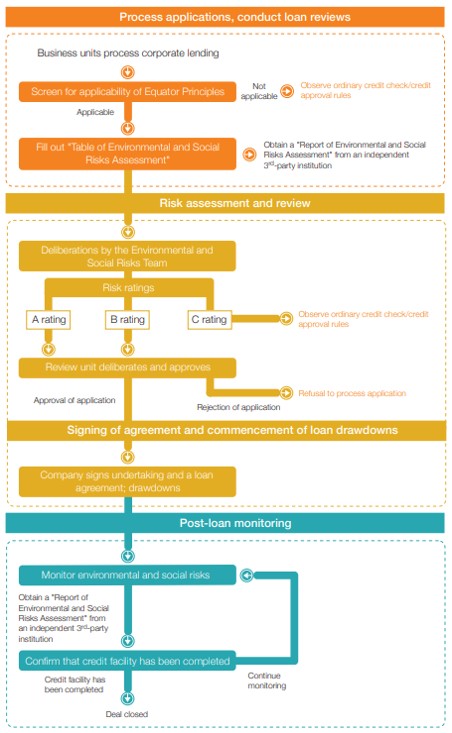

To implement environmental and social risk assessment strategy from the Equator Principles, O-Bank has established comprehensive structure and procedures for project finance in accordance with the Equator Principles.

Social and environmental risk ratings for corporate lending are assigned by O-Bank’s Environmental and Social Risks Team, which is chaired by the Head of the Risk Management Division.

Further details about O-Bank´s implementation of the EPs are provided at: https://www.o-bank.com/about/govern/risk-management/equator-principles