About us

The Signatories encourage robust implementation of the Equator Principles across all EPFIs

Home > About Us

Our Strategy

The Equator Principles (EP) Association launched its first ever Strategy at its Annual General Meeting in October 2020. This high-level statement (below) sets out the direction of travel for the Equator Principles over the next few years and demonstrates the collective willingness of Equator Principles Financial Institutions (EPFIs) to continually improve.

The Strategy guides the program of work and enable EPFIs and wider stakeholders to have a clear understanding of where the Equator Principles is headed and, as such, where to focus its attention and resources. The Strategy is aspirational and ambitious and, most importantly, is supported each year by tangible actions.

Accountability

Ambition

Adapt

People

Quality

Collaboration

Vision

Governance and Management

The Equator Principles (EP) Association was the unincorporated association of member Equator Principles Financial Institutions (EPFIs) whose object was the management, administration and development of the Equator Principles. Formed on 1 July 2010, the EP Association was instituted to ensure long-term viability and ease of management of the member EPFIs.

As of 1 January 2024 the Equator Principles Association was replaced by a new legal structure and the Equator Principles are now legally represented by Equator Principles Limited.

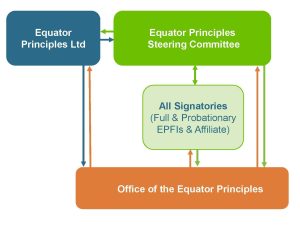

The Equator Principles are still governed by a Steering Committee, which is supported by the Office of the Equator Principles. Contracting on behalf of the Equator Principles is carried out by Equator Principles Limited. The governance structure is illustrated below.

Equator Principles Steering Committee

The Steering Committee co-ordinates management and development of the Equator Principles on behalf of the Signatories to the Equator Principles. The Steering Committee is elected by the Signatories to the Equator Principles.

Current members of the EP Steering Committee (as from November 2024) are listed below.

REGIONAL REPRESENTATIVES:

- Europe – EIFO (Denmark’s Export and Investment Fund)

- Latin America – BTG Pactual

- Asia-Oceania – MUFG Bank, Ltd & Export Finance Australia

- North America – Export Development Canada

- Middle East & Africa – Mauritius Commercial Bank

MANAGEMENT SUPPORT:

- ING Bank (Chair)

- UK Export Finance

Office of the Equator Principles

EP CEO

In May 2023, the Steering Committee appointed the Equator Principles’ first CEO, Max Griffin. As CEO, Max is responsible for the day-to-day leadership and management of the Equator Principles, on behalf of the Steering Committee, and will deliver key initiatives set in the annual work plan including:

- supporting the Chair and Steering Committee on governance, management structure and other strategic management issues;

- technical leadership for the development and provision of guidance for the Equator Principles;

- engaging and overseeing the work of third-party service providers and consultants;

- reviewing prospective EPFIs and implementation of recent joiners;

- supporting on external relations with various supranational bodies, regulators and CSOs, as required;

- identifying opportunities for the Equator Principles to engage and influence wider E&S sector initiatives, and providing input, as appropriate.

Max Griffin, EP CEO

EP Secretariat

The EP Secretariat is responsible for the day-to-day management and administration of the Equator Principles and provides a wide variety of services to the Signatories, Steering Committee and Chair, and CEO. These include:

- governance support to the EP Steering Committee, Regions and Working Groups;

- managing internal and external communications (including the EP website);

- organisation and facilitation of EP events;

- management of the Signatory application process;

- oversight of all EPFI reporting; and

- all other tasks required to support effective day-to-day running of the Equator Principles, including third party procurement, stakeholder engagement and database management.

The Secretariat comprises 2.5 FTE across 4 part-time team members, located in Europe, South America and Asia.

Annual Fee

Signatories to the Equator Principles are required to pay an Annual Fee to cover costs incurred in the management, administration and development of the Equator Principles. The budget is voted upon by Equator Principles Financial Institutions (EPFIs) each year, including the Annual Fee.

Financial institutions who wish to become an EPFI are required to pay an Application Fee, in addition to the Annual Fee. If a financial institution adopts part way through the financial year the Annual Fee amount is pro-rated.

In 2025, the Annual Fee for an EPFI is £7,000.

Please contact the Office of the EPs for more information on the Application Fee for new EPFIs and the Annual Fee for Affiliate Signatories.

Working Groups

The Equator Principles Working Groups provide a mechanism for the global EPFI community to help shape and guide the direction of EP updates and the development of new guidance and other resources to facilitate the robust implementation of the EPs.

EPFIs are not required to join a Working Group, however, they are encouraged to do so if they have specific expertise or interest in a particular area.

The list of Working Groups is updated each year to reflect the priorities and programme of work. The 2025 EP Working Group are outlined below.

In addition to the Working Groups, there are informal Discussion Groups on issues of interest to EPFIs such as Sustainable Finance and the E&S Regulatory environment.

| Working Group | Lead(s) | Purpose |

| Internal Areas (EP Review) | Export Development Canada & ING Bank | To support EP aims of ‘Keeping pace’ & consistency by prioritising topics for potential update in the EPs |

| External Areas (EP Review) | UK Export Finance & BTG Pactual | To support EP aims of ‘Keeping pace’ & consistency through engagement with EP partners, including IFC |

| Implementation | ING Bank & Mauritius Commercial Bank | To assist EPFIs with consistent application of the EPs |

| Capacity Building & Training | MUFG Bank | To assist EPFIs with consistent implementation by prioritising new, accessible learning resources |

| Biodiversity | National Australia Bank & EIFO | To provide biodiversity-related tools and guidance to EPFIs |

| Role of E&S Agents | Standard Chartered Bank & UK Export Finance | To better clarify the role of E&S Agent for EPFIs, through updated Guidance Note |

| Maritime Assets | Eksfin & EIFO | Watching brief in 2025 |

Partnerships

In addition to working closely with individual EPFIs, the Equator Principles has developed partnerships and collaborations with key organisations and initiatives:

International Finance Corporation (IFC) & World Bank

The Equator Principles are based on the IFC’s Performance Standards on Environmental and Social Sustainability. In February 2020 the Equator Principles and the IFC signed a Memorandum of Understanding (MoU) outlining the collaboration’s key tenet – to expand existing training and capacity building on Performance Standards.

Some supporting resources for Equator Principles practitioners are below:

IFC Performance Standards and Guidance Notes

IFC E-Learning Course on Managing Environmental and Social Performance

World Bank Development Indicators

World Bank Group Environmental, Health, and Safety Guidelines

United Nations Environment Programme Finance Initiative (UNEP FI)

In 2025 the Equator Principles will be collaborating with UNEP FI on activities related to nature-based financial risk management.

Global Biodiversity Information Facility (GBIF)

GBIF have worked with the EP Biodiversity Working Group to produce simple guidance that enables EFPIs and their clients to comply with EP4 requirements on sharing of biodiversity data.

Organisation for Economic Co-operation and Development (OECD)

The Equator Principles endorsed and provided input into an OECD document that provides an overview of good practice for Environmental and Social Agents.